Are You Missing Out On 529 Education Savings Plans?

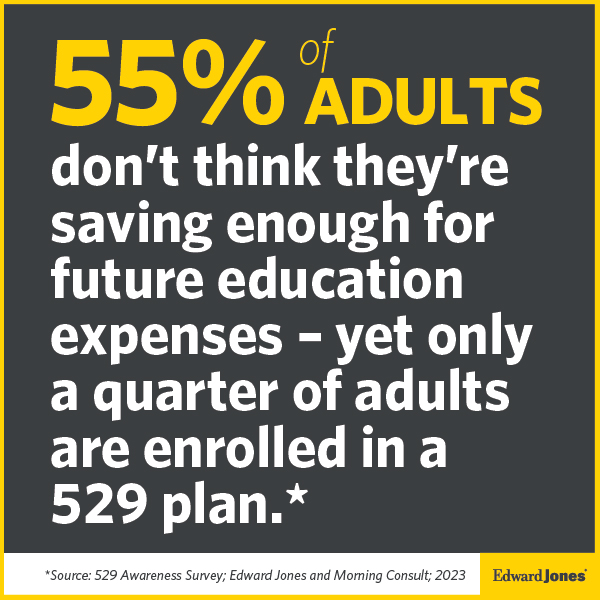

(NewsUSA) – How is it that so many people worry about how they’ll pay for college, and yet still haven’t taken advantage of 529 savings plans? Maybe because they could be one of the best-kept secrets around.

– How is it that so many people worry about how they’ll pay for college, and yet still haven’t taken advantage of 529 savings plans? Maybe because they could be one of the best-kept secrets around.

Not only do contributions to the plans grow federal tax-free – unlike, say, regular savings accounts – but also untaxed is money withdrawn to pay for tuition, books and other qualified education expenses.

You can get a rough idea of how much your child’s college education will wind up costing you with this online resource from the financial services firm Edward Jones. (Warning: Be prepared for sticker shock.) But know, too, that thanks to updates in the law, 529 plans can now also be used to fund up to $10,000 in tuition per year, per beneficiary, at elementary and secondary schools.